The telecommunications industry is a key driver behind Vietnam’s digital transformation. Telecommunications and other sectors in the information and communications technology (ICT) sector generated up to 8.2 percent of Vietnam’s GDP in 2021. As the country moves to implement the fourth industrial revolution, the telecommunications industry will play a vital role in the process.

The Vietnam telecommunication market size was worth US$6.3 billion in value in 2021, with a CAGR forecast of approximately 1 percent for the 2021-2027 period. The industry is set to scale further up as the digital transformation of businesses coupled with the pandemic has boosted soaring demand for internet and telecommunication services.

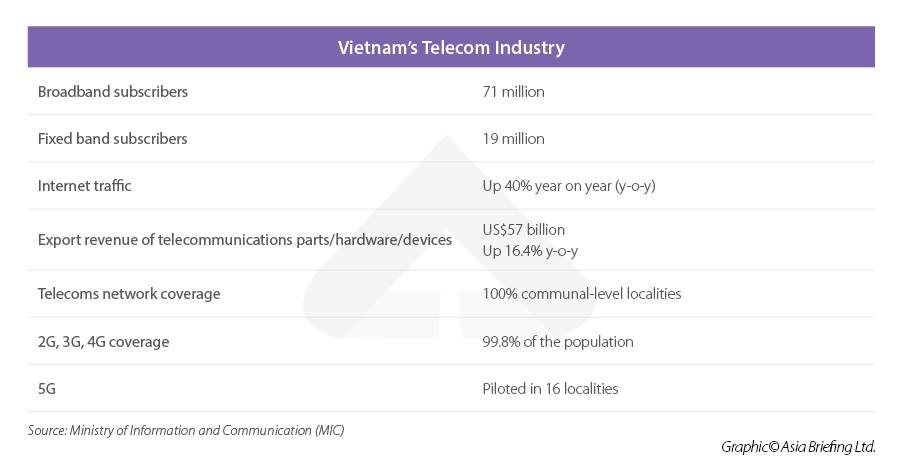

In 2021, 71 million mobile broadband subscribers and nearly 19 million fixed band subscribers were recorded, up by 4 percent and 14.6 percent respectively year on year. Meanwhile, an increase of 20 percent in the proportion of businesses utilizing the Internet of Things (IoT) was also reported in 2021, reaching 88.67 percent.

The overall performance of the telecommunications industry in Vietnam in 2021 can be observed in the following table.

The legal framework governing the telecommunications industry has been updated to promote the digital transformation of Vietnam. In January 2022, the Ministry of Information and Communications (MIC) updated Directive No.01/CT-BTTTT on the development strategy of the ICT industry, with specific goals for the telecom sector, for the 2022-2025 period.

The 2022-2025 goal of the telecommunications industry is as follows:

Annual goal

2022

2023

2024

2025

Total revenue of the telecoms industry

US$19.3 billion

US$21 billion

US$22.9 billion

US$25 billion

Contribution to GDP

4.9%

5%

5.1%

5.2%

5G coverage (percent of the population)

8%

14%

20%

25%

The rate of households with fiber optics

75%

84%

93%

100%

Mobile broadband subscribers (on 100 people)

85

90

95

100

Internet users (percent of the population)

74%

76%

78%

80%

IPv6 users (percent of the population)

52%

57%

65%

70-80%

The National Assembly has also approved the revised Law on Telecommunications and included it in the Law and Ordinance Development Program in Resolution No. 50/2022QH15.

The good news is, according to the representative of the Vietnam Internet Center, by June 2022, the rate of IPv6 had already reached 50%, achieving 96% of the goal as stated in the table. This has thus made Vietnam the country with the second highest IPv6 user rate in the ASEAN region and 10th worldwide.

Viettel Group, MobiFone, FPT, and VNPT are the current giants in Vietnam’s telecoms industry.

Since 2017 – the peak year in revenue for all telecoms players, only Viettel Group showed steady revenue growth. In 2021, the group generated VND 21.4 trillion (US$913 million), compared to a low of VND 4.3 trillion in 2017 (US$183 million). Meanwhile, MobiFone witnessed a fall from VND 940 billion (US$41 million) in 2017 to VND 710 billion (US$30 million) in 2021. The same pattern applied to the revenue of FPT as the corporation’s consolidated revenue peaked in 2017 at VND 42 trillion (US$1.7 billion) before dropping to VND 35 trillion (US$1.4 billion) in 2021.

This drop was attributed to the fact that traditional sectors in the telecommunications industry in Vietnam are shrinking, making way for new sectors. Viettel, on the other hand, foresaw the transition in the telecoms industry and was quick to adjust to the changing industry, which explained its revenue growth.

Recently, in April 2022, Viettel installed an undersea cable called the Asia Direct Cable (ADC) in Quy Nhon City, which will be in commercial use by 2023 to accelerate internet connection.

Other telecom giants are also preparing to step up their operations in the era of digital transformation.

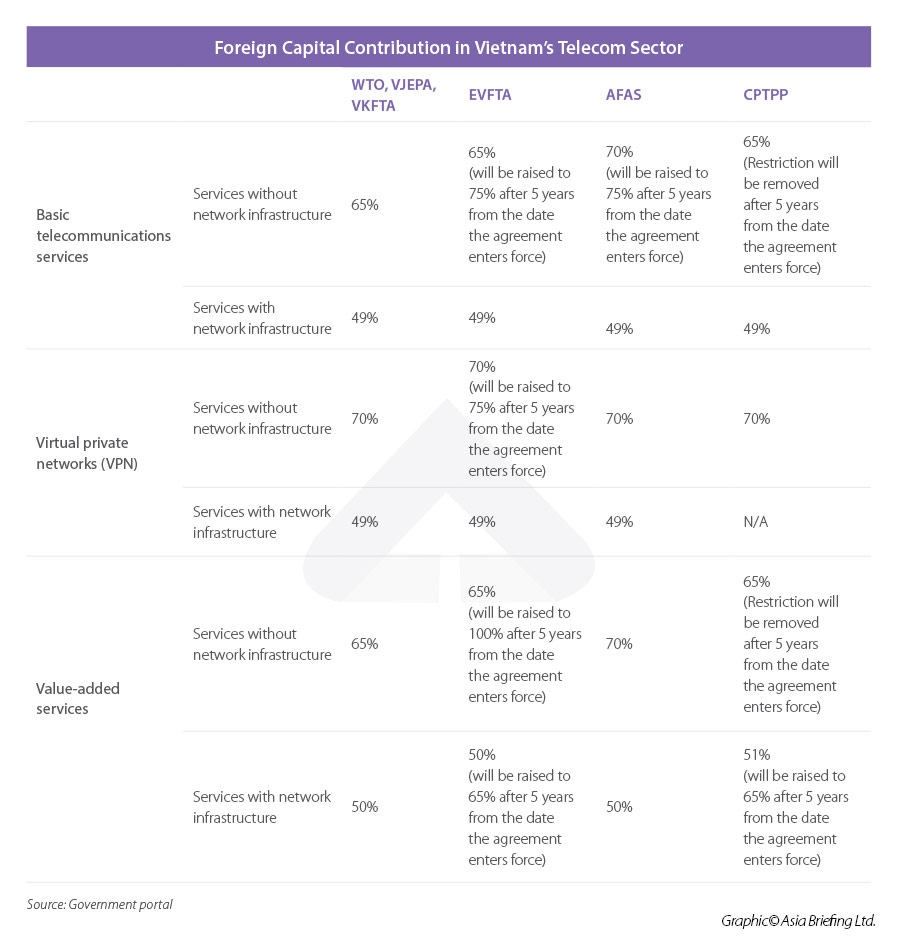

Due to high entry barriers, the telecoms industry in Vietnam is currently dominated by domestic players like FPT, NetNam, Viettel, and CMC, though CMC has 45 percent of shares owned by a Malaysian firm.

The Vietnamese government only allows foreign investment in the telecoms industry in the form of:

Any organization or individual that already owns more than 20 percent of the charter capital of a telecoms enterprise is not entitled to own more than 20 percent of the charter capital of another enterprise in the same segment.

However, foreign investors are allowed to own up to 100 percent of the undersea fiber optic cable transmission capacity ashore at the fiber optic cable station in Vietnam and can sell that capacity to any licensed telecommunications network operator in Vietnam.

The table provides the maximum percentage of foreign capital contribution allowed in the telecoms industry:

In December 2020, the government issued Decision No. 38/2020/QD-TTg, approving the list of high technologies and products eligible for incentive policies. The telecom industry enjoys incentives for the following segments:

It should be noted that technologies that are currently not included in the list but meet the requirements in clause 3 Article 5, clause 1 Article 6 of the Law on High Technologies and are vital to socio-economic development, can seek a decision from the Prime Minister via the Ministry of Science and Technology.

Segments included in Decision 38 that are eligible for the following incentives as stated in Decision No. 13/2019/ND-CP:

In the context of digital transformation, the telecommunications industry in Vietnam is seeing major transitions and competition. With the issuance of Decision 38 and the implementation of different trade agreements, Vietnam’s telecoms industry is looking more attractive for businesses. Investors should look to channel investment into this dynamic market to enjoy preferential policies and a favorable business environment.

For more information on how best to tap into the growing telecoms industry in Vietnam, investors can contact our experts to discuss market entry and solutions for entry barriers.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

Previous Article

« Vietnam’s Semiconductor Industry: Samsung Makes Further Inroads

Next Article

Vietnam has long established itself as a favorable destination for investors wanting to diversify their Asia presence. In recent years, this decision has…

Vietnam’s digital economy has seen significant growth over the last decade and is expected to be valued at US$57 billion by 2025. The country’s digital…

Dezan Shira & Associates´ brochure offers a comprehensive overview of the services provided by the firm. With its team of lawyers, tax experts, auditors and…

Dezan Shira & Associates helps businesses establish, maintain, and grow their operations.

Your email address will not be published.

document.getElementById( “ak_js_1” ).setAttribute( “value”, ( new Date() ).getTime() );

Stay Ahead of the curve in Emerging Asia. Our subscription service offers regular regulatory updates,

including the most recent legal, tax and accounting changes that affect your business.