blackdovfx

blackdovfx

Grid Dynamics (NASDAQ:NASDAQ:GDYN) was one of the first companies to go public via a SPAC merger. It went IPO back in 2019 through the merger with ChaSerg Technology Acquisition Corp. The company performed very well since its IPO, up almost 300% in just two years. However, I got caught in the broad market sell-off last year and am now down over 50% from its all-time high. I believe the sell-off offers investors a great buying opportunity. The company continues to benefit from the tailwinds of digital transformation and is posting very strong growth despite facing a weakening economy. Therefore I rate the company as a buy at the current price.

Grid Dynamics is a leading technology consulting company. It works with clients to provide enterprise-level digital transformations that help optimize business operations, improve efficiency, and reach more customers. While the company is still very small with a market cap of only $1.5 billion, it works with some of the largest brands in the world, including Apple (AAPL), Google (GOOG), Visa (V), Merck (MRK), and more. Grid Dynamics specializes in innovative technology such as digital commerce, AI, data, and cloud. Thanks to its positioning, the company is benefiting significantly from digital transformation, as the adoption of new technology continues to accelerate.

Grid Dynamics

Grid Dynamics

Digital Transformation has been one of the biggest trends in the past two decades. From the emergence of Google and Amazon (AMZN) to the first iPhone launch from Apple. Technology has completely taken over the world by storm. The recent pandemic only further boosted the adoption of new technology, with video conferencing and e-commerce leading the way. I believe the trend is not going to stop anytime soon as the importance of tech continues to increase.

For example, the cloud computing space has been expanding rapidly in the past few years, as seen with Azure and AWS. According to Precedence Research, the global cloud computing market is expected to grow from $380 billion in 2021 to $1.6 trillion in 2029, representing a CAGR of around 17.4%. Other emerging technology trends such as big data, AI, and digital experiences are also gaining strong traction, as they enable companies to vastly improves their operating efficiencies.

More and more brands are now turning to Grid Dynamics in order to keep up with the latest technology landscape. This is especially evident with legacy brands as they generally don’t have the technology required to strive in the modern environment. We are seeing companies like Walmart (WMT) and Kroger (KR) now adopting omnichannel consumer experiences through e-commerce and in-house apps in order to compete with Amazon. As the pace of digital transformation continues to accelerate, the demand for Grid Dynamic will only continue to increase.

Grid Dynamics

Grid Dynamics

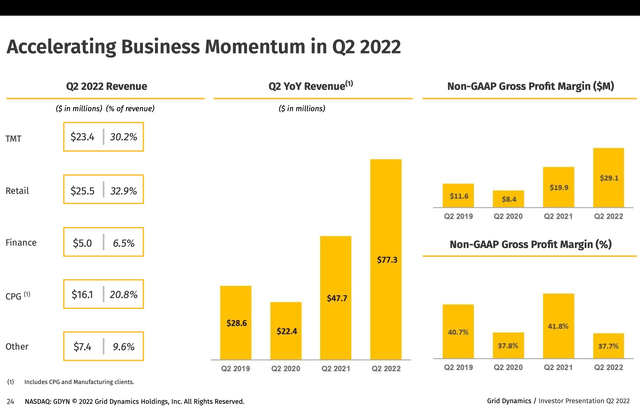

Grid Dynamics reported its second-quarter earnings in August. Despite facing a tough macro environment, the revenue growth rate was superb as it continues to see strong tractions across all verticals.

Leonard Livschitz, CEO, on second-quarter earnings.

We made significant progress across multiple facets of our business. This includes scaling our global presence with new locations, expanding our partnerships, adding new customers, and flawlessly transitioning a significant proportion of the workforce while continuing to deliver projects in a timely manner. Our company has shown incredible resilience and this is a testament of the company’s strong fundamentals

The company reported revenue of $77.3 million, up 62.2% YoY (year over year) from $47.7 million. Revenue from non-retail industry verticals grew 48.5% YoY, now representing 67.1% of total revenue, while revenue from the retail vertical increased 100%, now representing 32.9% of total revenue. The growth is driven by expansion into new geographies as well as higher spending from existing customers. Gross profit was $29.1 million compared to $19.9 million, up 46.2% YoY

Unlike most other high-growth companies, Grid Dynamics’ bottom line continues to improve. Non-GAAP EBITDA for the quarter was $13.3 million compared to $9.7 million, up 37.1% YoY. Non-GAAP EBITDA margin dipped slightly from 20.4% to 17.2%, as the company continues to ramp up headcount to meet increasing demand. Non-GAAP net income was $8.2 million compared to $6.1 million, up 34.4% YoY. Operating cash flow increased 128% from $6.7 million to $15.3 million. The company’s balance sheet remains very strong. It ended the quarter with $150 million in cash and only $4.7 million in debt, providing a lot of dry powder to reinvest in the business or even engage in M&A activities.

Grid Dynamics

Grid Dynamics

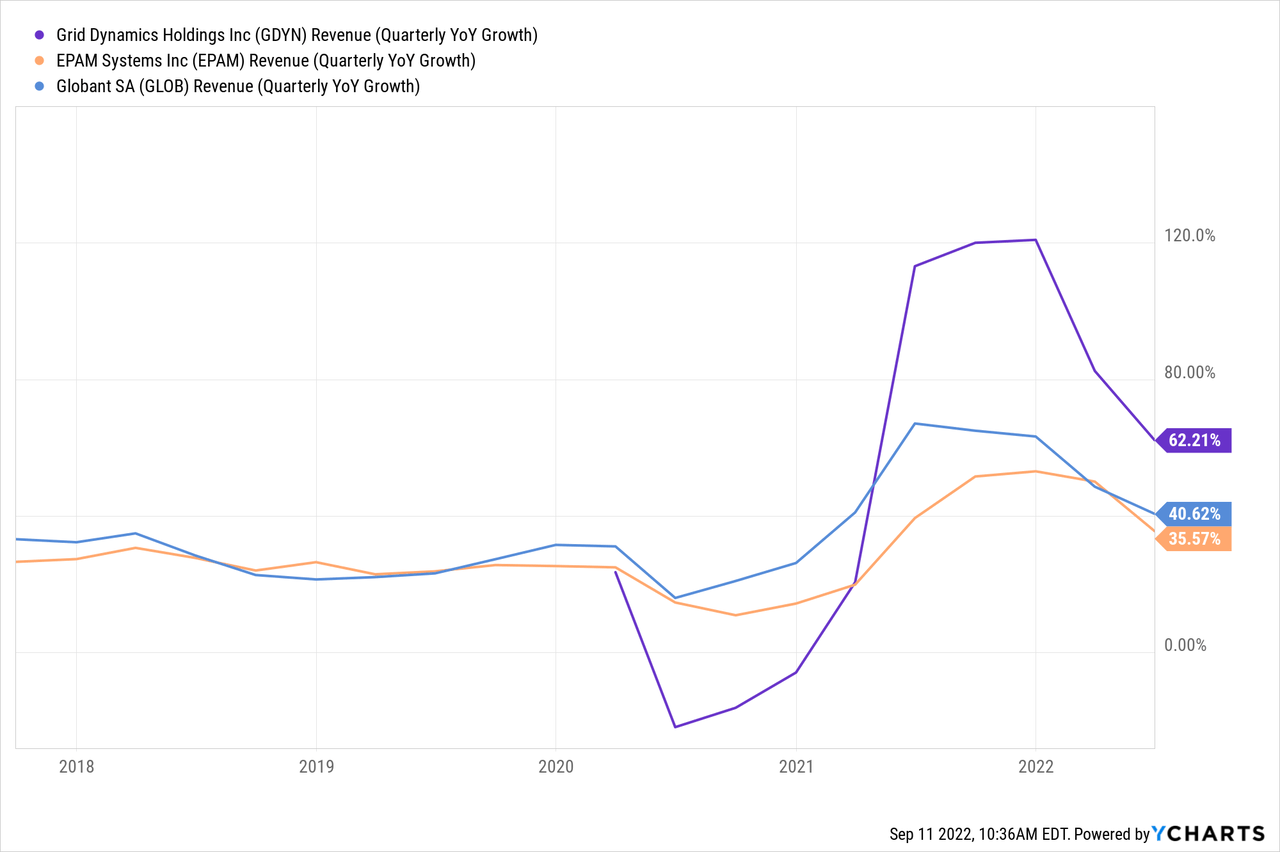

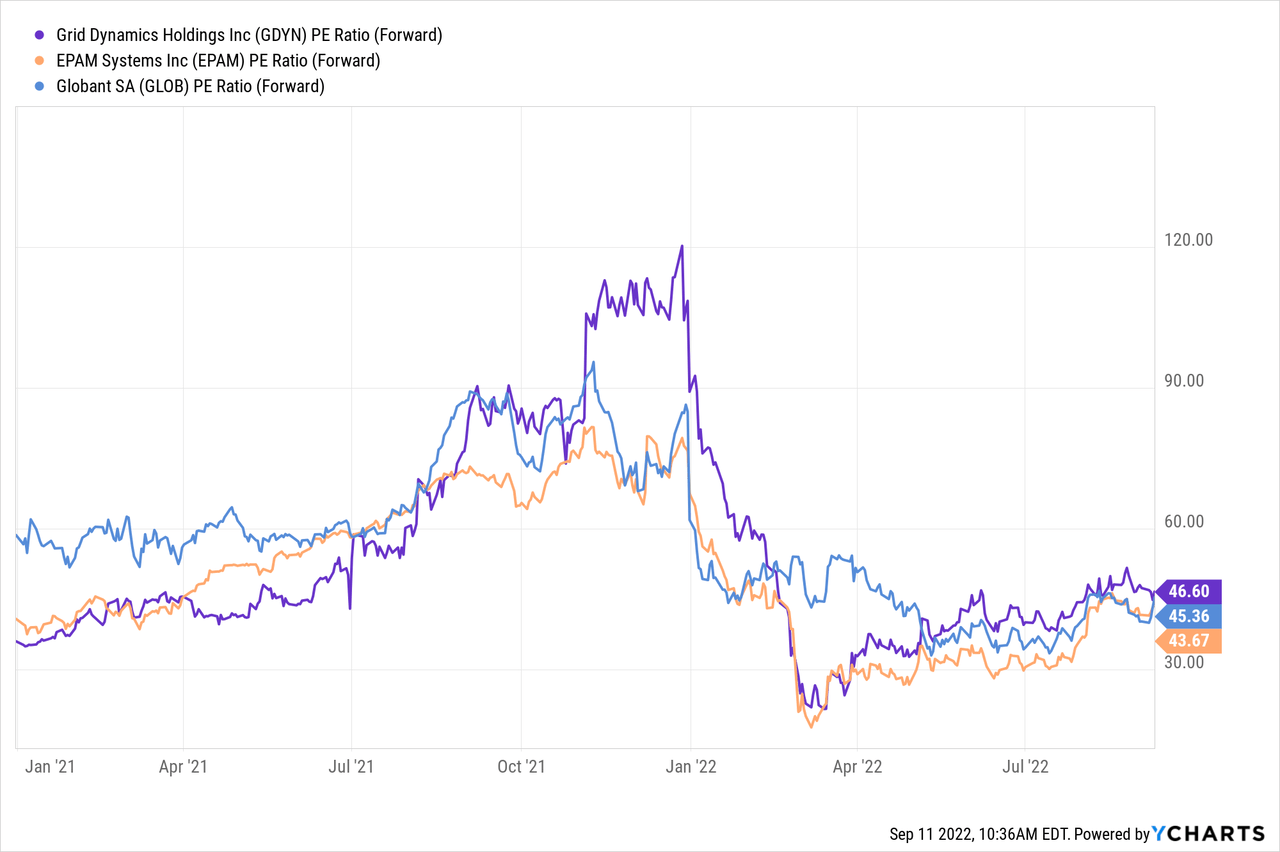

After the huge drop in share price, Grid Dynamic’s valuation has also come down significantly. It is currently trading at an fwd P/E ratio of approximately 46.6x, down from almost 120x last year. The company’s current valuation appeared to be in line when compared to other leaders in the tech consulting space such as EPAM Systems (EPAM) and Globant (GLOB), as shown in the first chart below. However, you can see that Grid Dynamics’ revenue growth significantly outpaced others in the recent quarter, as shown in the second chart below. Considering how strong the growth rate has been in the past few quarters, I believe Grid Dynamics should be trading at a higher multiple.

In conclusion, I believe Grid Dynamic has strong potential due to the strong positioning of its business. It is riding the tailwind of digital transformation as more and more companies are now adopting new technologies. The increasing amount and complexity of technology will also provide further tailwinds for the company. The company’s recent quarterly earnings showed very impressive growth as it continues to see strong demand across all verticals. After the drop, it is now also trading at a similar valuation compared to its peers while having a much higher growth rate. Therefore, I rate Grid Dynamics as a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.